Scalping is a preferred trading strategy for many traders due to the theory that small price changes are easier to predict than larger ones, and some short-term strategies propose less risk. As there is a very limited time exposure to the market, scalpers are less likely to run into overwhelming changes and pitfalls. However, scalping can also present risks from market volatility, as scalpers tend to trade in highly liquid and volatile markets, and this can result in losses.

We are trying to achieve as many small profits as possible with the use of Trailing-Take-Profit that allows you to set your Trailing-Stop-Loss to trigger only after a certain profit was reached and the help of Average True Range indicator that’s used to determine a safe place to put your SL or TP automatically and avoid being stop hunted or stopped out of a trade due to a tight Stop Loss. In addition to that you can use smart Parabolic SAR to trail your profits or stop orders as well.

What is Trailing-Take-Profit (TTP)

In one sentence – Trailing-Take-Profit allows you to set your Trailing-Stop-Loss to trigger only after a certain profit.

Meaning, it follows the uptrend and sets to close the position above a specific profit and below a defined loss. In other words, by setting a TTP, one can make sure that the profits made during the rising of the asset are secured, before the price goes down, deleting the profits.

The advantage of TTP on TSL is that Trailing-Stop-Loss may close the position following a downtrend that occurs immediately after the entry, missing potential profits. Trailing-Take-Profit, on the other hand, will not close the position until the target profit was reached. Only once the specified profit was reached, the trailing-stop will get into action and close the position when a specified loss occurs.

What is ATR

Average True Range (ATR) is the average of true ranges over the specified period. Indicator measures volatility, taking into account any gaps in the price movement.

ATR is very useful for stops or entry triggers, signaling changes in volatility. Whereas fixed dollar- point or percentage stops will not allow for volatility, the ATR stop will adapt to sharp price moves or consolidation areas, which can trigger an abnormal price movement in either direction. We are using multipler of ATR, such as 1.5x ATR, to catch these abnormal price moves.

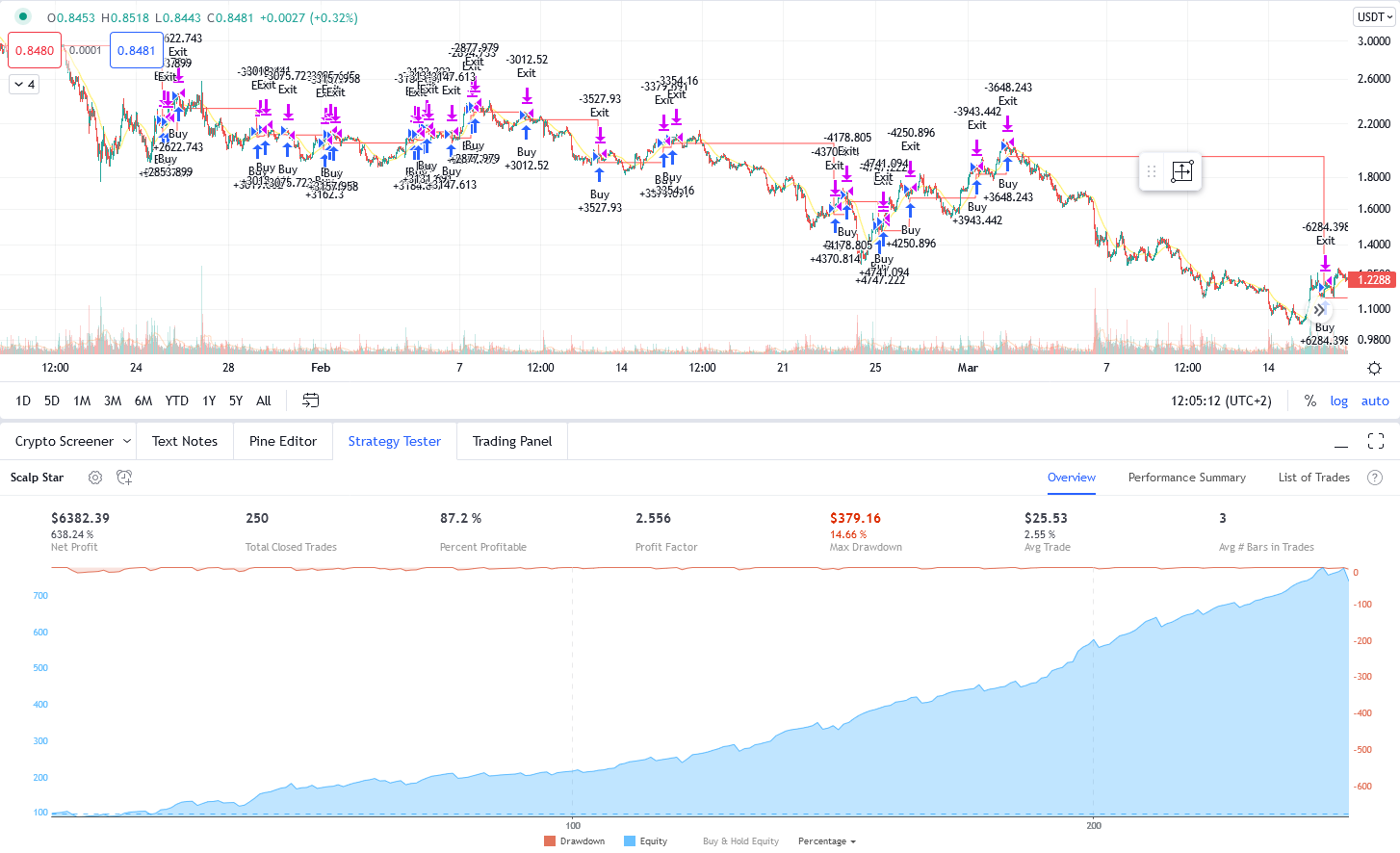

Example of trades on Scalp Star

In this example we can see how trading algorithm enters first buy order and exit trade by TSL. Second trade triggered our TSL after profit of 1% was reached, but then got sold on very high of a candle by hitting a green line (ATR Take Profit). Third trade didn’t reach or arm profit so there was no trailing or hitting ATR TP. It closed by hitting lower red line – ATR SL.

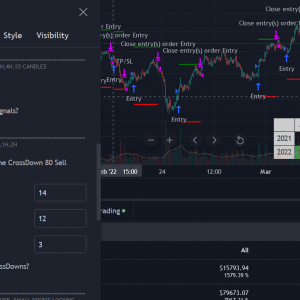

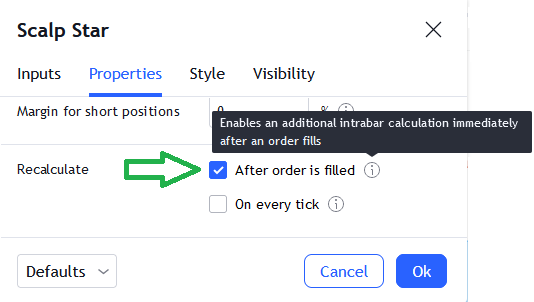

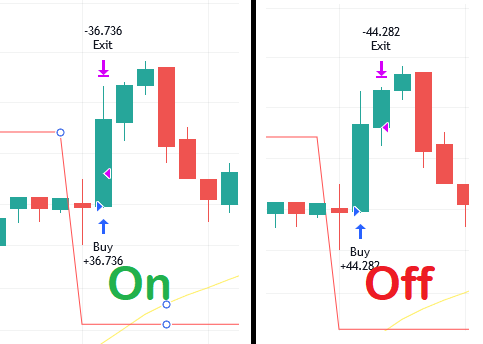

Strategy is buying or entering positions once per closed bar. It can trade more often if you enable recalculating ‘after order is filled’. More about that down below.

Scalp Star trading in percentage (%) or ticks

There are 2 versions of scalper. One is trading the usual way with % profits, the other one by ticks. What are ticks? The tick size is the smallest possible price change an instrument can have. In other words, when the price of an instrument fluctuates, it always changes with the size of at least one tick. This way our scalper can work much differently as you are always taking profits by fixed ticks not by percentage gain. If you buy 1 BTC, do you want to exit your trade when your reach profit in 100 ticks – let’s suppose that is 100$ profit or would you want to exit trade on 5% profit from entry order?

We recommend to trade with classical % strategy, but trading by ticks can bring big advantages on some coins.

When trading with ticks, use the lower right table like shown in the video above, to get the tick info for your market.

Trailing Profits

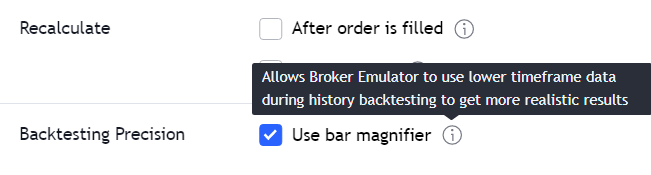

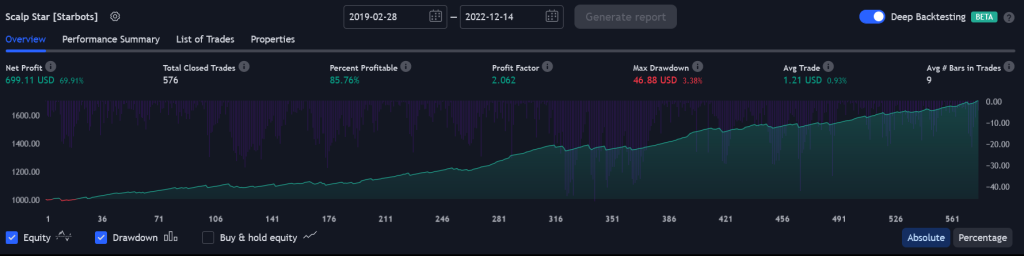

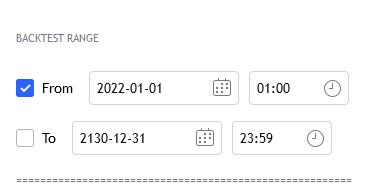

When backtesting trailing take-profit, trailing stop-loss, it’s highly recommended to have Premium Tradingview account, otherwise profit results exaggerate. You need ‘bar magnifier’ feature that’s only available for premium plans. Use it with ‘Deep Backtesting’. This 2 functions together will use lower timeframe data and make history backtesting of TSL more realistic.

My tip is to just never trust TSL backtest if normal Take Profit – Stop Loss doesn’t work similarly on your backtest beforehand, if it does – apply small trailing as it will always help your trading setup, you don’t need a premium subscription and bar magnifiers to know that. And because of that, we offer OPTIMIZING scripts for every strategy so you don’t have to worry about this. It’s testing without trailing, just a normal TP / SL or sell by strategy. Find something good on it and only then apply TSL to help your strategy score higher profits if you wish of course.

Strategy is also designed to trade only in uptrend where we are catching quick profits.

Quick Tips

- Scalp Star waits for the first (opening) bar to close before catching profits on your new open order (All % percent based strategies does). Scalp Star (ticks) version is able to execute sell orders on the first opening bar right after it without a problem – smarter/ faster strategy.

By default TradingView strategy trades only once per bar (1 buy per bar or 1 sell per bar) on Scalp Star version which is trading in percentages (%). Buy and sells are not allowed to happen in the same bar.

Scalp Star (ticks) can buy and sell inside the same bar by default.

It’s actually recommended to trade the ticks version to be faster and sell immediately if you need to.You could use ‘After order is filled’ on Scalp Star to make it work similar to Scalp Star Ticks version, but that feature is repainting and will buy multiple times per bar too. Try to avoid using it.

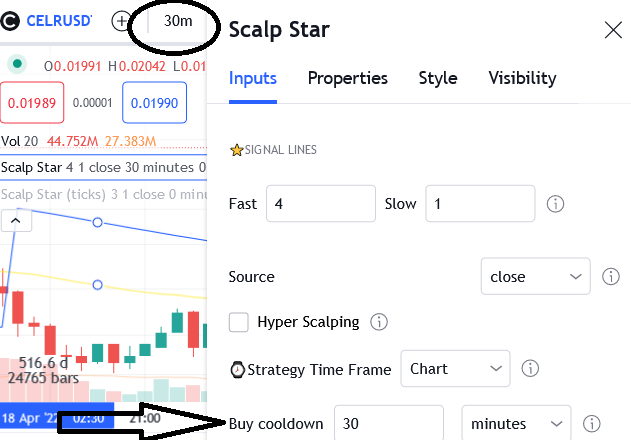

- You can also turn on cooldown after buys, to delay and maybe limit it from spamming buys that day.

- Scalping strategy is working the best on 30min-1h-2h charts. Make sure to test your parameters over recent months of market not just long term in strategy settings.

You can use flat Take Profit or ATR Take Profit, PSAR of course. There are more options not just TSL in this strategy.

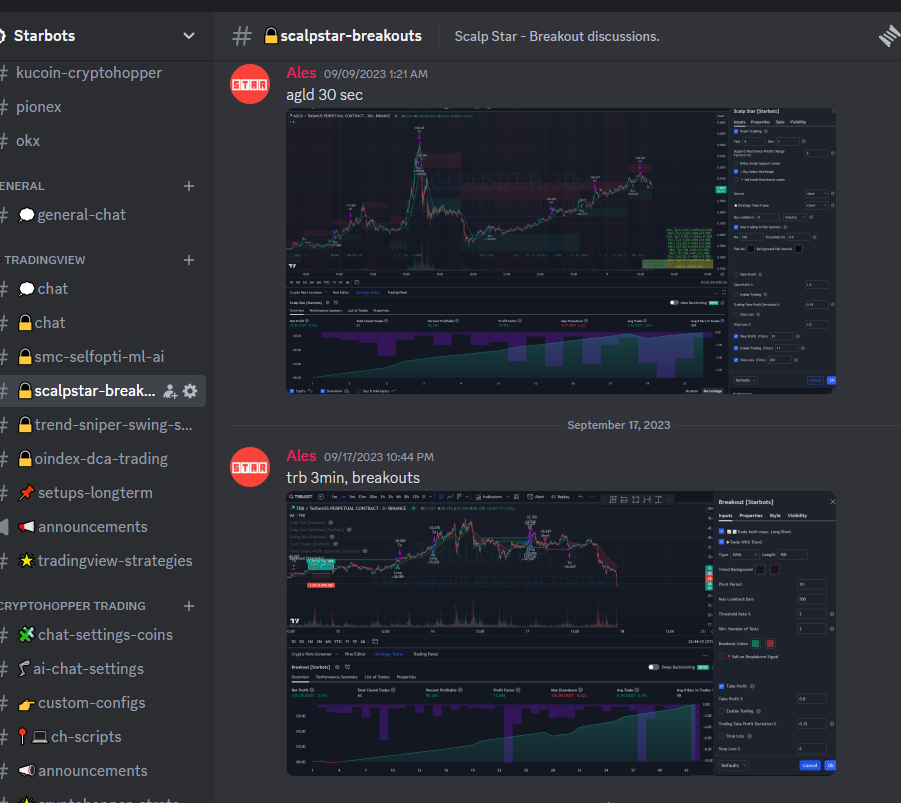

All Star strategies use dynamic alerts

By using Star Bots Trading Algorithms, you agree with the terms of EULA and consent to be bound by them. You use the Trading Algorithm at your behalf and at your own risk. Star Bots is not responsibile or liable for your’s direct or indirect losses, damages, costs and expenses. You are not allowed to edit, copy, reproduce, distribute, resell, use the Trading Algorithm for signalling services, copy-trading or otherwise use the Trading Algorithm for your own or other’s interests or for any commercial purpose. If such or any other breach of EULA occur, you’re contract will be terminated immediately and you are obligated to stop all access and use of this Strategy.