Self Optimizing Parabolic SAR Strategy (non-repainting)

https://www.tradingview.com/script/mAS1TbtZ-Self-Optimizing-PSAR-Starbots/

Script constantly tests 169 different combinations for maximum profitability and trades based on the best performing combination at that time.

It’s optimizing based on 13×13=169 different parameters of ‘Increment’ factor of Parabolic SAR indicator.

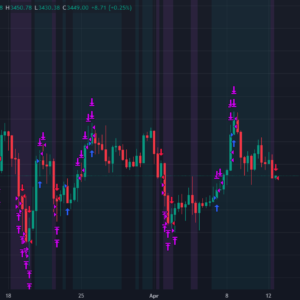

You will notice that signal plots switch after a bar close, this is when the strategy optimizes to the better combination and change combination, strategy is dynamic – but always calculating only on the closed bar.

The logic of optimizing:

buy1 with sell1 – buy1 with sell2 – buy1 with sell3,…

buy2 with sell1 – buy2 with sell2 – buy2 with sell3,…

buy3 with sell1 – buy3 with sell2 – buy3 with sell3, buy3 with sell4,….

……

buy13 with sell1 – buy13 with sell2,….

If you wish to use it as INDICATOR – turn on ‘Recalculate after every tick’ in Properties tab to have this script updating constantly and use it as a normal Indicator tool for manual trading.

———————————————————————————————————

# Parabolic SAR

Parabolic SAR is a time and price technical analysis tool created by J. Welles Wilder and it’s primarily used to identify points of potential stops and reverses. In fact, the SAR in Parabolic SAR stands for “Stop and Reverse”. The indicator’s calculations create a parabola which is located below price during a Bullish Trend and above Price during a Bearish Trend.

www.tradingview.com/chart/?solution=4…

———————————————————————————————————–

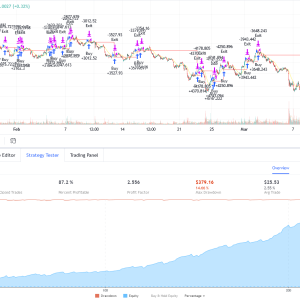

Strategy example is backtested on Daily chart of SHIBUSDT Binance

Long: on ; Short: on ;

Only Take Profit at 3% is turned ON the rest of the settings are OFF

0.1% fee, 1000initial capital, 100 order size, 1 tick slippage

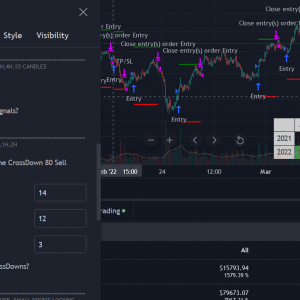

Settings:

-Start = default Parabolic SAR setting is 0.02

-Max Value = default Parabolic SAR setting is 0.2

–Recommended PSAR Increment settings:

0.02 is default, higher timeframes usually performs good on the faster Increment factors 0.03-0.05+, smaller timeframes on slow Increment factors 0.005-0.02. I recommend you the most common and logical 15 different Increment factors for optimizing in the strategy as default already (from 0.005 to 0.065 – strategy will then optimize based on the most profitable combination).

– Noise-Intensity Filter 🐎0.00-0.20%🐢

This will punish the tiny trades made by certain combinations and give more advantage to big average trades. It’s basically like fee calculation, it will deduct 0.xx% fee from every trade when optimizing.

You will usually want to have it around 0.05-0.10% like your fees on exchange.

-> 🐎Less than <0.10% allows strategy to be VERY SENSITIVE to market.

-> 🐢More than >0.10% will slow down the strategy, it will be LESS SENSITIVE to market volatility.

Close Trades on Neutral

After a lot of Trades, Algo starts developing self-intelligence. It can also have a neutral score. (Grey Plots). Sell when the strategy is neutral.

Other settings:

-Take Profit, Multiple Take Profit, Trailing Take Profit, Stop Loss, Trailing Stop Loss with functional alerts.

-Backtesting Range – backtest within your desired time window. Example: ‘from 01 / 01 /2020 to 01 / 01 /2023’.

– Strategy is trading on the bar close without repaint. You can trade Long-Sell/Short Sell or Long-Short both directions. Alerts available, insert webhook messages in the inputs.

– Turn on Profit Calendar for better overview of how your strategy performs monthly/annualy

– Notes window : add your custom comments in here or save your webhook message text inside here for later use. I find this helpful to save texts inside.

Recommended TF : 4h, 8h, 1d (Trend Indicators are good at detecting directions of the market, but we can have a lot of noise and false movements on charts, you want to avoid that and ride the long term movements)

This script is fairly simple to use. It’s self-optimizing and adjusting to the markets on the go.

By using Star Bots Trading Algorithms, you agree with the terms of EULA and consent to be bound by them. You use the Trading Algorithm at your behalf and at your own risk. Star Bots is not responsibile or liable for your’s direct or indirect losses, damages, costs and expenses. You are not allowed to edit, copy, reproduce, distribute, resell, use the Trading Algorithm for signalling services, copy-trading or otherwise use the Trading Algorithm for your own or other’s interests or for any commercial purpose. If such or any other breach of EULA occur, you’re contract will be terminated immediately and you are obligated to stop all access and use of this Strategy.

All Star strategies use dynamic alerts

https://www.youtube.com/watch?v=2-qw3NYeDtgDiscord chat and setups