Self Optimizing Supertrend Strategy. (non-repainting)

https://www.tradingview.com/script/7j6dfI3Z-Self-Optimizing-Supertrend-Starbots/

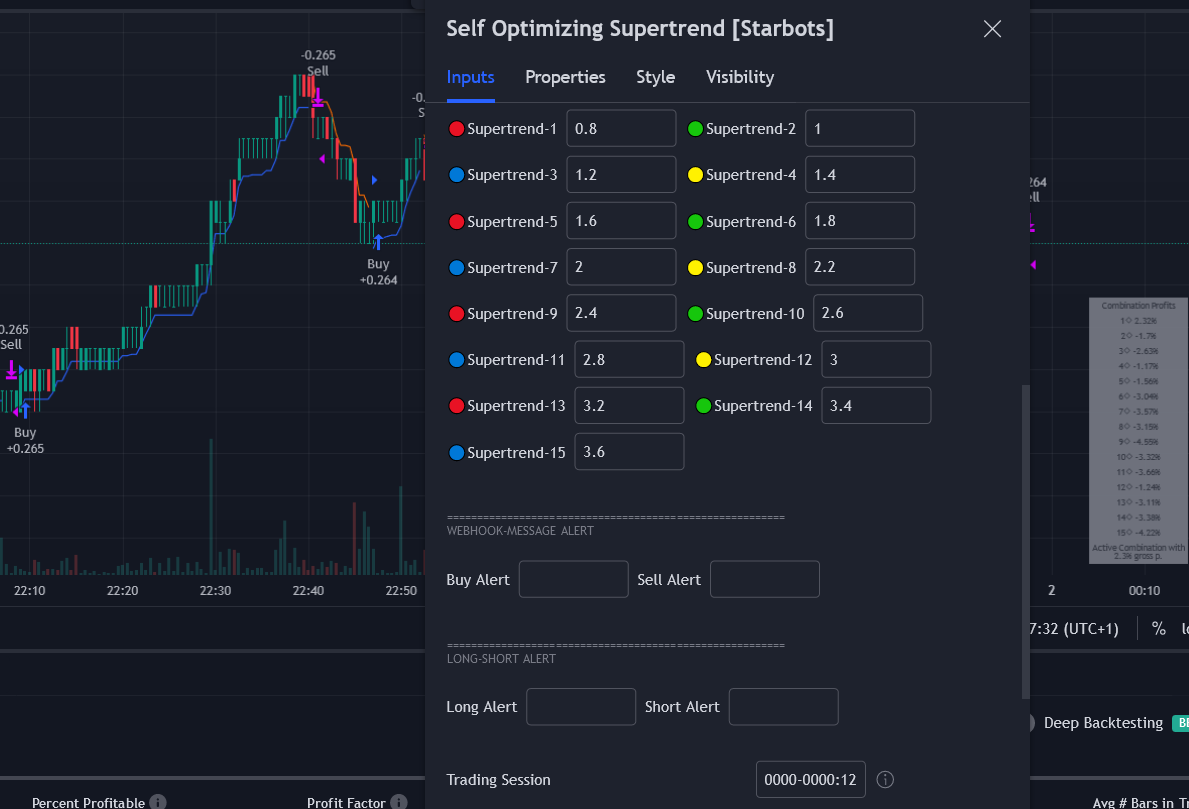

Script constantly tests 15 Supertrend combinations for maximum profitability and trades based on the best performing combination.

You will notice that signal lines switch after a bar close sometimes, this is when the strategy optimizes to the better combination and change plots, strategy is dynamic.

———————————————————————————————————

# Average True Range (ATR)

The Average True Range (ATR) is a tool used in technical analysis to measure volatility . Unlike many of today’s popular indicators, the ATR is not used to indicate the direction of price. Rather, it is a metric used solely to measure volatility , especially volatility caused by price gaps or limit moves.

# Supertrend

A Super Trend is a trend following indicator similar to moving averages. It is plotted on price and the current trend can simply be determined by its placement vis-a-vis price. It is a very simple indicator and is constructed with the help of just two parameters- period and multiplier.

When we construct the Supertrend indicator strategy, the default parameters are 10 for Average True Range (ATR) and 3 for its multiplier. The average true range (ATR) plays a key role in ‘Supertrend’ as the indicator uses ATR to compute its value and it signals the degree of price volatility .

———————————————————————————————————–

-Turn on Supertrend Profit Dashboard and spot the worst/best performing combination. You can change them to get the best performance overall.

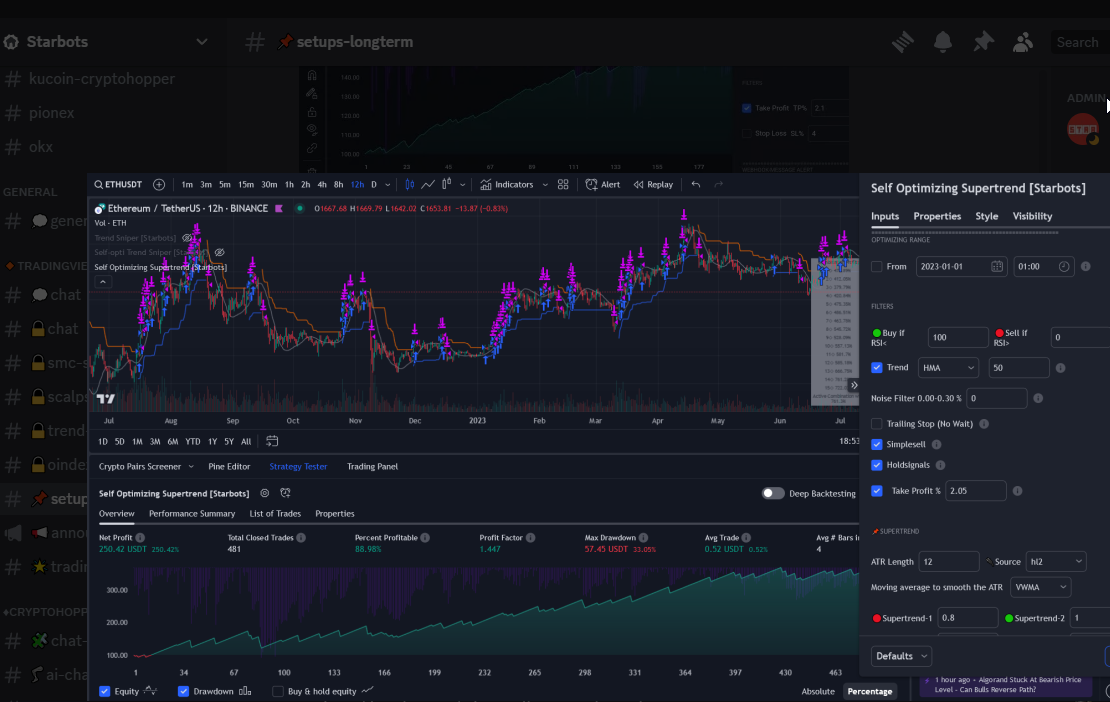

-Backtesting Range – backtest within your desired time window. Example: ‘from 01 / 01 /2020 to 01 / 01 /2023′.

-Optimizing range – you can decrease the amount of bars/data for optimizing script. This way you can keep it up to date to more recent market by selecting optimizing range to optimize it just from the recent 3-6months of data for example. Strategy before this selected range will normally trade (backtest) based on the fifth buying condition (5. Supertrend Factor) parameter in your menu (1.6 by default) if you turn this on.

*I recommend ‘Optimizing Range’ turned off actually, use max amount of available bars in your history for optimization script.

– Strategy is trading on the bar close without repaint. You can trade Long-Sell or Long- Short. Alerts available, insert webhook messages.

– Turn on Profit Calendar for better overview of how your strategy performs monthly/annualy

– Recommended ATR Length : 10 (default), higher timeframes usually performs good on the shorter period lengths 6-10, smaller timeframes on the larger ATR period length 10-20.

– Recommended Sources : hl2 (default Supertrend), close, hlc3, hlcc4 (when scalping/day trading and market is uptrending good, you can use ‘volume’ as a source, comes in handy)

– Recommended Smoothing Moving Average for ATR : We smooth the ATR calculation with moving average, traders usually use SMA as a moving average here, but you can use alternatives like EMA , HMA . Try them if this improves your results.

– Recommended TF : 15min, 30min, 1h, 2h, 4h, 8h, 1d (low timeframes works good if you have no fees like Binance currently do on BTC for example otherwise you probably want to use 1/2h+ chart)

– Supertrend Factor parameters : pre-set Supertrend Factors are very good and common in trading world, you don’t need to change them, but you can do it at free will. Traders usually use Supertrend factor of 2 or 3, use parameters around this numbers.

– Notes window : add your custom comments in or save your webhook message text inside here for later use.

– Trading Session: in a session, you have to specify the time range for every day. It will trade only within this window and close trades when it’s out. Session from 9am to 5pm will look like that: 0900-1700 or 7am to 4:30pm 0700-1630. After the colon, you can specify days of the week for your trading session. 1234567 trading all days, 23456 – Monday to Friday (‘1 is Sunday here’). 0000-0000:1234567 by default will trade every day nonstop. 00.00am to 00.00pm and 1234567 every day of the week for example – Cryptocurrencies.

This script is simple to use for any trader as it saves a lot of time for searching good parameters on your own. It’s self-optimizing and adjusting to the markets on the go.

Also if you want to use this as live indicator instead of strategy – you can turn on ‘Recalculate – after every tick’ and hide signal labels.

By using Star Bots Trading Algorithms, you agree with the terms of EULA and consent to be bound by them. You use the Trading Algorithm at your behalf and at your own risk. Star Bots is not responsibile or liable for your’s direct or indirect losses, damages, costs and expenses. You are not allowed to edit, copy, reproduce, distribute, resell, use the Trading Algorithm for signalling services, copy-trading or otherwise use the Trading Algorithm for your own or other’s interests or for any commercial purpose. If such or any other breach of EULA occur, you’re contract will be terminated immediately and you are obligated to stop all access and use of this Strategy.

All Star strategies use dynamic alerts

https://www.youtube.com/watch?v=2-qw3NYeDtgDiscord chat and setups